Please be advised that our working hours during the month of Holy Ramadan, are scheduled as follow:

General

Monday – Friday : 8.00 AM – 3.30 PM

Customer Support

Monday – Friday : 8.00 AM – 5.00 PM

Saturday : 8.30 AM – 2.30 PM

Regular working hours will resume on the first working day after Eid el-Fitr holiday.

Wish you all happy and blessed Ramadan!

Best Regards

Sabre Travel Network Indonesia

Customer support after office hours/ weekends/ public holiday

HP : 08121862323

Email : helpdesk@sabretn.co.id, technical@sabretn.co.id, marketing@sabretn.co.id , electra@sabretn.co.id

Related Articles

-

Four More Asian Carriers Adopt Abacus Paperless EMD Technology

[ezcol_1half id=”” class=”” style=””] Abacus International, the leading travel solutions provider in Asia Pacific, today announced that four more Asian carriers have adopted the Abacus electronic miscellaneous document (EMD) technology: Singapore Airlines, SilkAir and Cathay Pacific, together with Hong Kong-based Dragonair. Responding to the IATA mandate for all miscellaneous documents issued from January 2014 to be electronic, many airlines have partnered with Abacus to implement the required proprietary technology, creating a new paperless ticketing environment. Beyond the benefits of full digitization, carriers gain the ability to track their ancillary sales, with Abacus e-coupons for lounge access, baggage, in-flight Wifi and more. Databases will be more closely aligned with the trade channel on transactions. “With Abacus EMD, airlines can simultaneously go green, drive efficiencies and boost yields,” explained Division Head, Airline Distribution at Abacus, Ho Hoong Mau. “We are delighted to help four more powerful brands in Asia’s burgeoning aviation industry to achieve the EMD standard, realizing the benefits in terms of cash and credit card reimbursements and ancillary sales through the region’s trade channel.” Lee Ser Yi, Vice President, Corporate Sales and Distribution, Singapore Airlines added, “Adopting the Abacus EMD solution allows Singapore Airlines to improve our customer experience by automating miscellaneous fees and deposit payments, while reducing paper dependency and related costs. We are pleased to be able to take this to our key customers through Abacus.” Singapore Airlines, SilkAir, Cathay Pacific and Dragonair join the extensive list of global airlines who have adopted the Abacus EMD solution, contributing to IATA’s planned sunset of the legacy virtual Miscellaneous Charge Order (vMCO). For more information, contact: marketing@abacus.com.sg. [/ezcol_1half] [ezcol_1half_end id=”” class=”” … READ MORE

-

Abacus Central Asia Forms Strategic Partnership with Association of Corporate Travel Executives to Boost Regional Education and Technology

[ezcol_1half id=”” class=”” style=””] Abacus International, Asia Pacific’s leading provider of travel services and solutions, today announced a strategic partnership with the Association of Corporate Travel Executives (ACTE), the global organisation pioneering educational and technological advances in business travel. The two organisations, collaborating on initiatives to develop corporate travel in the Central Asian Republics are starting by co-hosting the third Abacus Corporate Travel Executive Forum in Almaty at the end of October 2013. The aim is to facilitate knowledge transfer between multi-national businesses developing commercial links with Kazakhstan, together with travel management companies and corporate travel agencies working with their Central Asian counterparts. Key topics for the Forum include traveller trends and intelligence, Government policy as it relates to corporate travel and new areas of travel policy compliance and process innovation, with Abacus contributing on the latest technological advances. Pavel Spitsyn, General Manager, Abacus Central Asia, explained, “This is an important initiative in helping to construct the framework for the industry to better engage with Kazakhstan, both as a destination and an outbound market. We look forward to partnering with ACTE to understand and unlock more of Central Asia’s potential, working with the local business travel community.” “We are pleased to partner with Abacus given the strength of their travel solutions regionally and we believe our partnership will positively impact the industry across Central Asia,” said Benson Tang, Regional Director at ACTE. “Facilitating knowledge transfer at a high level, this is a strategic step for ACTE.” The Forum takes place on the 29th and 30th October at the Rixos Almaty Hotel. Contact marketing@abacus.com.sg for more information. [/ezcol_1half] [ezcol_1half_end id=”” class=”” … READ MORE

-

Eid Mubarak Greetings & Sabre Indonesia Office Hour During Lebaran Period

Eid Mubarak to You and Your Family! All management and staffs of PT Sabre Travel Network Indonesia would like to send the warmest greetings to all those celebrating Eid Al-Fitr. May the blessings of Allah fill your life with happiness and open all the doors of success now and always. Due to the Eid Al-Fitr holidays, please note that Sabre Indonesia offices will be temporarily closed from 11 – 20 June 2018. During the holidays, our Helpdesk and Electra Developer team will remain stand by on June 11 – 14 and 18 – 20, from 8.30 AM to 2.30 PM. Customer Support after office hour HP : 0816 920 832 atau 0812 186 2323 Email : helpdesk@sabretn.co.id, technical@sabretn.co.id, marketing@sabretn.co.id , electra-support@sabretn.co.id Thank you for your kind attention and Happy Holiday! Best Regards, Sabre Travel Network … READ MORE

-

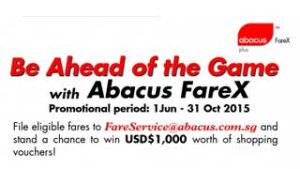

Be Ahead of The Game with Abacus FareX for Airlines

-

Sabre to acquire Abacus International

SOUTHLAKE, Texas, and SINGAPORE, May 14, 2015 – Sabre Corporation (NASDAQ: SABR) announced today that it has entered into a definitive agreement to acquire Abacus International, the leading global distribution system (GDS) in the Asia-Pacific region. Abacus is currently owned by a consortium of 11 Asian airlines along with Sabre, which has a 35% stake in the company. Sabre will purchase the remaining portion of Abacus for net cash consideration of $411 million. “The Asia-Pacific travel market is the largest and fastest growing in the world,” said Tom Klein, Sabre President and CEO. “Acquiring Abacus immediately combines the global capabilities of Sabre with the deep local market expertise of the leading Asia-Pacific GDS. This powerful combination will give customers even more innovation and service options, while allowing Sabre to accelerate growth globally in a very capital efficient way – and to gain regional synergies in all three of our businesses serving travel agents, airlines and hospitality companies.” Abacus International President and CEO, Robert Bailey added, “With our extended network in Asia-Pacific, Abacus has built a trusted brand of unique significance and scale. We now have the opportunity to take the business forward even faster, broadening the scope within the Sabre family and with the support of our shareholder carriers. This is great news for the industry in Asia-Pacific, and we look forward to passing the benefits of integration to all sectors of this region’s diverse travel community.” Abacus serves more than 100,000 travel agents across the Asia-Pacific region’s 59 markets and has both global and uniquely local relationships with airlines and hotels, including the leading portfolio of low-cost content and Chinese airline content. Separately, the acquisition includes new long-term distribution agreements between Sabre and the 11 airline owners of Abacus. “We look forward to continuing our long-term business relationships with our former partners in Abacus, and our new agreements will provide benefits and confidence to travel agents throughout the Asia-Pacific region for many years to come,” said Greg Webb, President of Sabre Travel Network. “Abacus currently provides a broad set of services to its customers using a base of Sabre technology for the large majority of core functions to market, distribute, sell and service travel in the Asia-Pacific region,” Webb added. “That, along with deep local market capabilities, will result in a smooth transition for Asia-Pacific customers, who should see the benefits of global capabilities while continuing to use our familiar, leading technology.” Abacus will operate as a region of Sabre Travel Network, and Sabre expects its expanded Asia-Pacific direct presence will benefit Sabre Airline Solutions and Sabre Hospitality Solutions, which already provide mission-critical support to 78 airlines and thousands of hotels throughout the Asia-Pacific region. Sabre also will continue its partnership to provide technology services to INFINI, a local Japanese GDS. “Sabre and Abacus have established the gold standard for service and content in the Asia-Pacific region, and that only gets better,” Klein said. “Together with Abacus, Sabre will provide customers and suppliers with improved and faster access to Sabre’s industry-leading innovations, including low-cost carrier content, ancillary capabilities, data analytics, and the latest in mobile solutions and personalization services. Additionally, airlines and travel agencies will have more options for new and differentiated products and services created specifically for customers in the Asia-Pacific market.” Subject to regulatory approvals and other closing conditions, the transaction is expected to close in the third quarter of 2015. The acquisition, including associated working capital adjustments and cash acquired, is expected to be financed through approximately $250 million in cash on hand, augmented by incremental net debt of approximately $160 million. Pro forma for the transaction, Sabre estimates its March 31, 2015 net debt to trailing twelve months Adjusted EBITDA ratio would be 3.3x, compared to 3.0x as reported. Assuming a third quarter closing date, Sabre expects the transaction will increase 2015 revenue by approximately $120 million, be approximately neutral to 2015 Adjusted EPS and modestly accretive to current-year Adjusted EBITDA. In 2016, Sabre expects the transaction to increase revenue by more than $300 million, to increase Adjusted EBITDA by approximately $50 million and to be accretive to Adjusted EPS by approximately $0.05. Conference Call Sabre will conduct an investor conference call on Thursday, May 14 at 11:00 a.m. Eastern Time. The live webcast, including accompanying slide presentation, can be accessed via the Sabre Investor Relations website at investors.sabre.com. A recording of the call will be archived for replay following the conference call. About the Company Sabre Corporation is a leading technology provider to the global travel and tourism industry. Sabre’s software, data, mobile and distribution solutions are used by hundreds of airlines and thousands of hotels to manage vital operations, such as passenger and guest reservations, revenue management, and flight, network and crew management. Sabre also operates the world’s leading travel marketplace, processing more than $110 billion of annual travel spend. Headquartered in Southlake, Texas, USA, Sabre operates in approximately 60 countries around the world. Website Information We routinely post important information for investors on our website, www.sabre.com, in the Investor Relations section. We intend to use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document. Forward-looking statements Certain statements in this release are forward-looking statements about trends, future events, uncertainties and our plans and expectations of what may happen in the future. Any statements that are not historical or current facts are forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “will,” “expect,” “would,” “estimates,” “may,” “potential” or the negative of these terms or other comparable terminology. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Sabre’s actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. The potential risks and uncertainties include, among others, the closing and effects of the acquisition described in this release, dependency on transaction volumes in the global travel industry, particularly air travel transaction volumes, adverse global and regional economic and political conditions, including, but not limited to, conditions in Venezuela and Russia, dependence on maintaining and renewing contracts with customers and other counterparties, exposure to pricing pressure in the Travel Network business, dependence on relationships with travel buyers, changes affecting travel supplier customers, travel suppliers’ usage of alternative distribution models, and competition in the travel distribution market and solutions markets. More information about potential risks and uncertainties that could affect our business and results of operations is included in Part I, Item 1A, “Risk Factors” in Sabre’s Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. Unless required by law, Sabre undertakes no obligation to publicly update or revise any forward-looking statements to reflect circumstances or events after the date they are made. Note on Non-GAAP Financial Measures This release refers to unaudited non-GAAP financial measures, including Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, and the ratios based on these financial measures. We define Adjusted EBITDA as Adjusted Net Income adjusted for depreciation and amortization of property and equipment, amortization of capitalized implementation costs, amortization of upfront incentive consideration, interest expense, net, and remaining provision (benefit) for income taxes. We define Adjusted Net Income as income (loss) from continuing operations adjusted for impairment, acquisition related amortization, loss on extinguishment of debt, other, net, restructuring and other costs, litigation and taxes, including penalties, stock-based compensation, management fees, and tax impact of net income adjustments. We define Adjusted EPS as Adjusted Net Income divided by the applicable share count. We present non-GAAP measures when our management believes that the additional information provides useful information about our operating performance. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with … READ MORE

-

DELIVER THE BEST DEALS WITH ABACUS HOTEL PROMOTION Q4

-

EMIRATES GDS WASTAGE RECOVERY

Dear Trade Partner, Over the years, Emirates has been actively educating the trade to help Airlines reduce their continuously increasing GDS costs. While most part of this cost is unavoidable, there is certain wastage that can be controlled by you. Unproductive segments like HX, UC, NO and UN keep adding to the airline’s costs if not cancelled by your staff members on time. We would like to inform you that effective 01st October 2014, Emirates Airline will be raising ADMs for the recovery of such costs incurred due to such unproductive segments from your respective agency. The ADMs will be posted and settled through BSP billing. We urge you to educate your team members to adopt the policy of checking and removing such unproductive segments on a regular basis to avoid debits in this regard. Please feel free to contact Emirates Sales Team for any briefing and guidelines that may be needed. We thank you for your understanding and look forward to Nil GDS wastage which can only be achieved with your support. Thank you, Emirates Indonesia One Pacific Place Building 10th floor Jl. Jend. Sudirman kav 52-53 … READ MORE

-

Letter From Jet Airways – Jet Airways GDS Policy

Dear our valuable agents partner From now on, we shall not accept any further ADM waiver from you should this ADM is containing of GDS misuse policy, some of them are as follows: Duplicate PNR booking- ADM raised due to Duplicate PNR booking. As per the GDS misuse policy creating duplicate bookings in the same passenger name record (PNR) or across PNRs for the same passenger is prohibited. Also Post investigation we see that tickets were not issued for the misused PNRs, hence the ADM holds good for the same. Churning the PNR more then 3 times – As per the GDS misuse policy Travel service providers must avoid repeated cancelling and re-booking of the same or different flight, class, date or route (known as churning) to circumvent ticketing time limits or for any other reason whatsoever; as this leads to unreasonably high booking / cancelling volumes. Fictitious Name booking – PNR was generated using fictitious name. TEST/MR.Travel Service providers must not create any fictitious bookings, that block the airline’s inventory in the live GDS environment, Please klik to find attached detail of our GDS miss-use policies. Kindly please circulate and inform this to all of your respective staffs and or branch offices. Thanks Regards, Ikhsan Sarwa Raharja, Mr. Reservation & Ticketing Staff PT.AEROJASA PERKASA (AeroGSA) Aerowisata Park, Jl. Prof. DR.Soepomo No.45, Tebet, Jakarta 12810 Office hours: 0800 – 1700 (Weekdays) Saturday & public holiday – Closed Phone : +62 21 8370 2636 Fax : +62 21 8370 8376 Email: 9wsales@ajp.aerowisata.com … READ MORE