Dear All Travel Agents,

These are the SKYTEAM Fares Entries On Abacus System ,

- Round TheWorld Entry (FQSELSEL01SEPRW-KE )

- GO Africa Entry ( FQNBOJNB05MARIT-KQ/USD )

- GO China Entry ( FQCANSHA20MAY-CZ¥PSKY )

- GO Italy Entry ( FQROMPMO20MAY-AZ¥PITX )

- GO Russia Entry ( FQMOWLED01MAYIT-SU )

Happy Booking ,

Thanks and Regards,

Customer Support Abacus Indonesia

Updated RV/14/05/12

Related Articles

-

Abacus voted ‘Best New Technology’ for the 2015 China Travel & Meetings Industry Awards

SHANGHAI, May 8th, 2015 – Abacus, the Asia Pacific region’s leading travel solutions provider was voted the ‘Best New Technology’ in its category for the prestigious 2015 China Travel & Meetings Industry Awards, hosted in Shanghai on May 6th. TravelWeekly China readers credited the technology company’s pioneering mainland team for their ‘most outstanding product innovation and R&D’ with a ‘first-class product’ developed to achieve ‘competitive advantage’. Abacus’s treatment of industry partners was another component in the selection criteria. This is the eighth consecutive year in which Abacus has received the accolade and follows two decades of investment in travel agency solutions customised for the China market. Peter Li, General Manager for Abacus China received the award from Irene Chua, Travel Weekly China Group Publisher at the glittering event hosted by TravelWeekly China at the Ritz-Carlton, Shanghai. “This is a reflection of the commitment of our Abacus team to China’s travel agent community. We are working hard to provide the complementary technologies that drive greater productivity while also increasing our agents’ access to new content and markets,” said Li. “We are very appreciative of the support shown by subscribers to TravelWeekly China. Thank you all for an unforgettable night.” For more information, contact Abacus at www.abacuscn.com or call the toll-free Customer Support at 800-810-0390 (Mon-Sun, … READ MORE

-

Sabre Office Hours During Ramadhan

Please be advised that our working hours during the month of Holy Ramadan, are scheduled as follow: General Monday – Friday : 8.00 AM – 3.30 PM Customer Support Monday – Friday : 8.00 AM – 5.00 PM Saturday : 8.30 AM – 2.30 PM Regular working hours will resume on the first working day after Eid el-Fitr holiday. Wish you all happy and blessed Ramadan! Best Regards Sabre Travel Network Indonesia Customer support after office hours/ weekends/ public holiday HP : 08121862323 Email : helpdesk@sabretn.co.id, technical@sabretn.co.id, marketing@sabretn.co.id , … READ MORE

-

Eid Mubarak Greetings & Sabre Indonesia Office Hour During Lebaran Period

Eid Mubarak to You and Your Family! All management and staffs of PT Sabre Travel Network Indonesia would like to send the warmest greetings to all those celebrating Eid Al-Fitr. May the blessings of Allah fill your life with happiness and open all the doors of success now and always. Due to the Eid Al-Fitr holidays, please note that Sabre Indonesia offices will be temporarily closed from 11 – 20 June 2018. During the holidays, our Helpdesk and Electra Developer team will remain stand by on June 11 – 14 and 18 – 20, from 8.30 AM to 2.30 PM. Customer Support after office hour HP : 0816 920 832 atau 0812 186 2323 Email : helpdesk@sabretn.co.id, technical@sabretn.co.id, marketing@sabretn.co.id , electra-support@sabretn.co.id Thank you for your kind attention and Happy Holiday! Best Regards, Sabre Travel Network … READ MORE

-

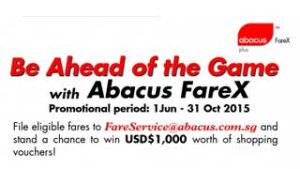

Be Ahead of The Game with Abacus FareX for Airlines

-

Happy New Year 2019

Happy New Year! Please be informed that our office will be closed on Tuesday, 1 January 2019 and for Monday, 31 December 2018, Our Customer Service operating hours will be changed from 08.00 AM – 14.00 PM. We will reopen on Wednesday, 2 January 2019. Thank you for your kind attention and happy holiday! Best Regards, Sabre Travel Network Indonesia Customer support after office hours HP : 0816920832 or 0812862323 Email : helpdesk@sabretn.co.id, technical@sabretn.co.id, marketing@sabretn.co.id, Electra Indonesia … READ MORE

-

Abacus Study Reveals Vast Untapped Opportunities for Mobile

Despite soaring adoption rates of smartphones and tablets across Asia Pacific, mobile applications remain a largely untapped opportunity within the travel industry here, according to a regional study released by Abacus International today. This is one of the primary findings of the ‘2013 Abacus Corporate Travel Practices Survey’ which collated the views of the most influential corporate travel companies and corporate travel agencies in Asia Pacific to uncover vital trends that are expected to impact their businesses over the next two to three years. Revealing a clear disconnect between the perceived importance and actual provision of smartphone and tablet applications in the industry, 83 per cent of respondents felt mobile technology would have a moderate to significant impact on their business, but only a third (33%) of those surveyed had implemented any mobile web or native applications as yet. Additionally, of those available only four in ten enable flight and hotel bookings via mobile and only one in ten provide the ability to make changes to existing arrangements. Just one in seven had created a specific app for tablet users. Corporate travel policy was another area where the prevailing trend was not reflected in the practice of agents. Despite the positive economic outlook acknowledged by all, 97 per cent had received instructions from clients to further tighten their policy terms. The pressure has led to increased demand for alternative flight and accommodation options, right into the long tail. More budget travel has clearly resulted. 73 per cent of respondents noted higher low-cost carrier (LCC) bookings for corporate travellers, mostly to comply with policies governing the choice of lowest fare. Robert Bailey, CEO of Abacus International notes, however, that the LCCs are also reaching out to the corporate sector much more. “While the low-cost market in Asia has yet to fully embrace corporate travel distribution, some budget carriers are now clearing a path to the corporate accounts, recognising the scale of the opportunity with trade partners, particularly on routes where low-cost competition is beginning to crowd out,” he said. Two patterns of corporate booking tool adoption were also seen to be emerging, which the study explores in more detail. Secondary expense management systems as a source of competitive differentiation were also identified, with over half looking to jump in on their popularity soon. “Despite the challenges, travel agencies are better placed to capitalise on the trends as they affect their businesses,” added Bailey. “The essential technology and content is already available and customised for clients in many different commercial settings.” The 2013 Abacus Corporate Travel Practices Survey was completed in April 2013 and is published today. For more information, contact … READ MORE

-

Discover The Best Hotel Deals With Abacus Hotel Promotion Q2

-

Winners For Hotels Q3 Promotion Announced

The Hotels Quarterly Promotion (Q3) featuring hotel properties from Indonesia, Korea, Malaysia, Philippines, Taiwan and USA ended on 30 September 2015. Sabre-connected travel agents who made materialised bookings during the promotional period qualified for themselves a chance to win a complimentary hotel stay with breakfast for two. Click here to see if you are one of the lucky winners. Congratulations to … READ MORE